CT Rent Rebate – The CT Rent Rebate Program is a state-funded program that provides rental assistance to eligible tenants in Connecticut. The program is intended to help low-income households and elderly or disabled individuals who are struggling to pay their rent. The program is administered by the Connecticut Department of Revenue Services (DRS) and the Connecticut Office of Policy and Management (OPM).

Eligibility for CT Rent Rebate Program

To be eligible for the CT Rent Rebate Program, applicants must meet the following criteria:

Age requirements: Applicants must be at least 65 years old or be 50 years old and the surviving spouse of a renter who was eligible for the program at the time of their death.

Income limits: Applicants must have a gross income of less than $37,600 if single, or $45,800 if married. The income limits are subject to change each year.

Disability and veteran status: Applicants who are disabled or are veterans may be eligible for additional benefits.

How to Apply for CT Rent Rebate Program

To apply for the CT Rent Rebate Program, follow these steps:

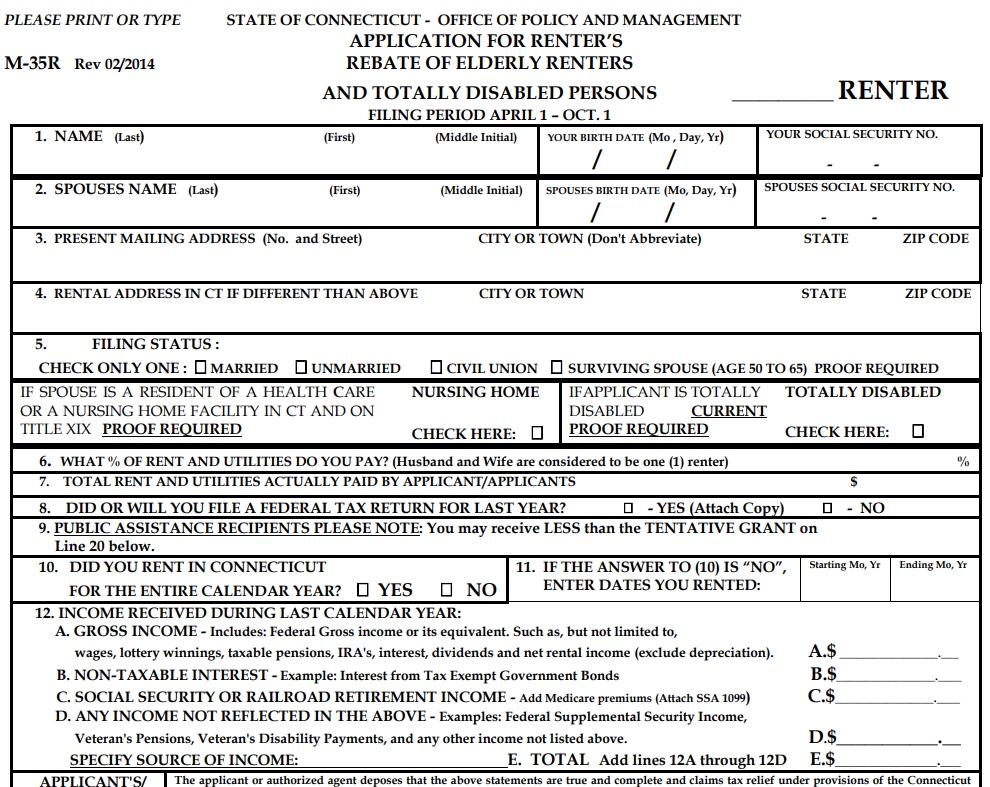

Application process: Download and complete the application form from the DRS website, or request a paper application by calling 860-297-4889.

Documents required: You will need to provide proof of income, such as a Social Security statement or a tax return, as well as a copy of your rent receipt or lease you may also need to provide documentation of disability or veteran status, if applicable.

Deadline for submission: The deadline for submitting the application is usually October 1st of the year following the year for which the rebate is claimed. However, due to the COVID-19 pandemic, the deadline for the 2020 application was extended to November 15, 2021.

Frequently Asked Questions (FAQs)

Q: What is the maximum rebate amount for the CT Rent Rebate Program? A: The maximum rebate amount for the program is $900 for married couples and $700 for individuals.

Q: How is the rebate amount calculated? A: The rebate amount is calculated based on a sliding scale, taking into account the applicant’s income and rent paid.

Q: Can I apply for the CT Rent Rebate Program if I live in subsidized housing? A: Yes, you can still apply for the program if you live in subsidized housing. However, the amount of the rebate may be reduced if your rent is already subsidized.

Q: Can I receive both the CT Rent Rebate Program and the federal Housing Choice Voucher Program? A: Yes, you can receive both programs as long as you meet the eligibility criteria for each program.

Conclusion

The CT Rent Rebate Program can provide much-needed rental assistance to eligible tenants in Connecticut. If you are struggling to pay your rent and meet the eligibility criteria, it is worth applying for the program. The application process is straightforward, and the program can provide up to $900 in rental assistance. If you have any questions about the program, visit the DRS website or call their hotline for assistance.