Maine Rent Rebate – The Maine Rent Rebate program is a financial assistance program offered by the Maine Revenue Services for eligible renters. The program provides funds to renters who meet certain income and residency requirements to help offset the cost of rent or property taxes. With the rising cost of living, especially in urban areas, this program can be a lifeline for many renters struggling to make ends meet. In this post, we will discuss the eligibility requirements, how to apply for the program, the deadline to file, and additional benefits for seniors.

Eligibility for Maine Rent Rebate

To be eligible for the Maine Rent Rebate program, applicants must meet the following requirements:

- Age and income requirements: Applicants must be at least 62 years of age or permanently disabled, and have a total household income of less than $23,900 (for single filers) or $32,400 (for joint filers).

- Residency and rental agreement requirements: Applicants must have lived in Maine for the entire year and have paid rent for at least 6 months in the year. The rental agreement must also be in the applicant’s name, and the rental unit must be their primary residence.

- Documentation required: Applicants must provide proof of income, residency, and rent payments for the year.

How to Apply for Maine Rent Rebate

The Maine Rent Rebate program application can be completed online through the Maine Revenue Services website or by mailing a paper application to the provided address. To apply, applicants will need to provide the following information:

- Personal information (name, address, Social Security number)

- Proof of income (W-2 forms, Social Security statement, etc.)

- Proof of residency (driver’s license, voter registration, etc.)

- Proof of rent payments (lease agreement, cancelled checks, etc.)

Maine Rent Rebate Deadline

The deadline to file for the Maine Rent Rebate program is typically June 1st of the year following the tax year for which the rebate is claimed. It’s important to note that missing the deadline can result in loss of eligibility for the program, so applicants should make sure to file on time.

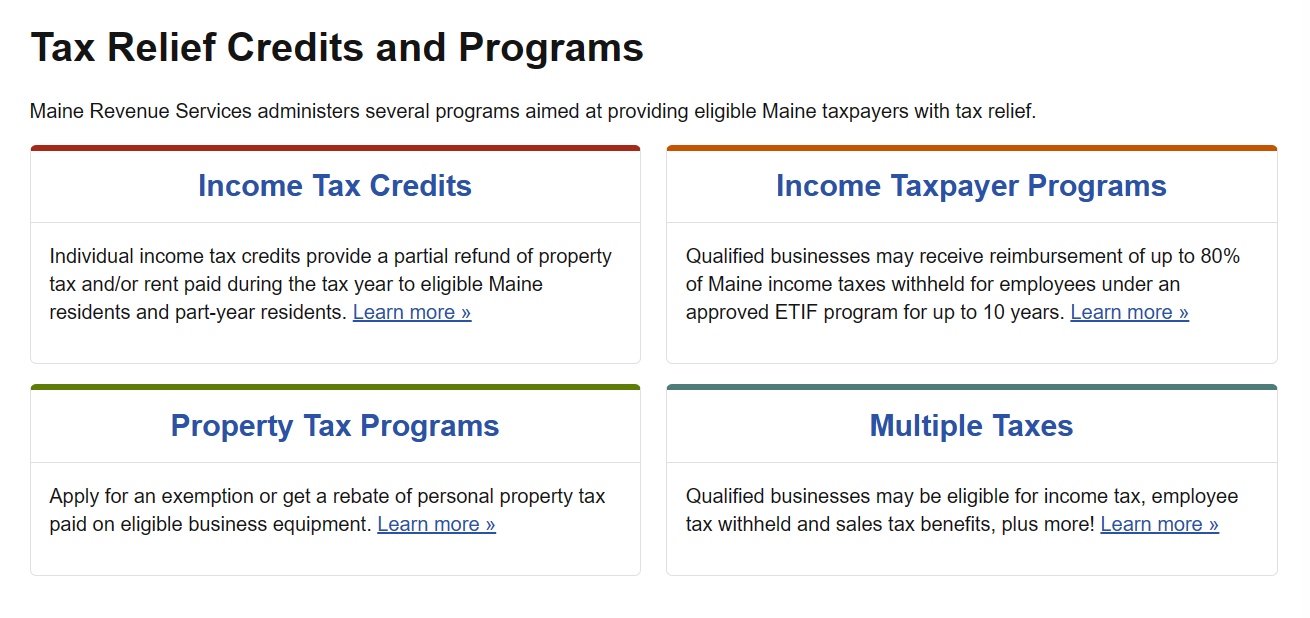

Rent Rebate vs Property Tax Assistance

While the Maine Rent Rebate program provides financial assistance for renters, the Maine Property Tax Assistance program is designed to help homeowners with property tax payments. Renters may also be eligible for the property tax program if they pay property taxes as part of their rent. However, the eligibility requirements and application process for the property tax program differ from those of the rent rebate program. Applicants should carefully review both programs to determine which is best for their individual needs.

Maine Rent Rebate for Seniors

In addition to the general eligibility requirements, seniors may be eligible for additional benefits through the Maine Rent Rebate program. Seniors who meet the age and income requirements may also qualify for an increased rebate amount. Applicants should indicate their senior status on their application and provide proof of age and disability if applicable.

Conclusion

The Maine Rent Rebate program can provide much-needed financial assistance for renters who meet the eligibility requirements. It’s important for eligible renters to apply on time and provide all necessary documentation to ensure they receive the maximum rebate amount. Seniors may also be eligible for additional benefits through the program. For more information and to apply, visit the Maine Revenue Services website.