Minnesota Rent Rebate Form – Welcome to our comprehensive guide on the Minnesota Rent Rebate Form. If you’re a resident of Minnesota and currently renting your home, you may be eligible for a rent rebate through the state’s rental assistance program. In this article, we will provide you with detailed information about the Minnesota Rent Rebate Form, how to fill it out correctly, and everything you need to know to successfully claim your rental rebate. Let’s dive in!

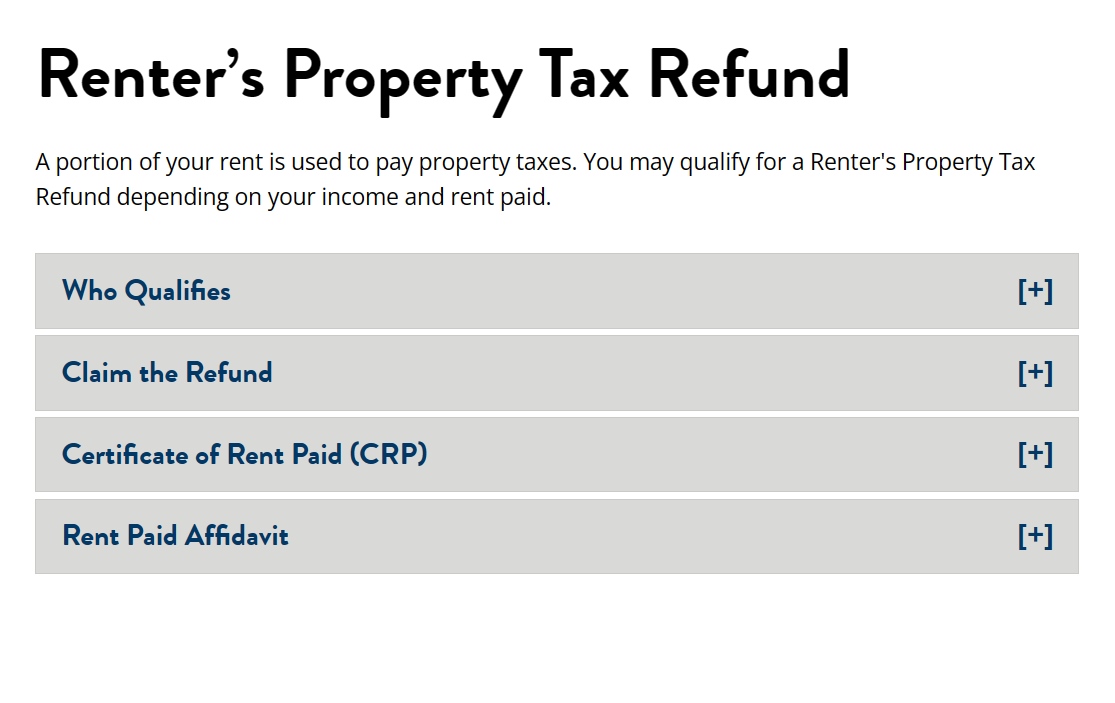

Understanding the Minnesota Rent Rebate Program

The Minnesota Rent Rebate Program is designed to assist low-income individuals and families in paying their rental expenses. It provides financial relief by offering eligible renters a rebate on a portion of their rent payments. The program aims to ensure affordable housing options and prevent homelessness.

To qualify for the Minnesota Rent Rebate Program, applicants must meet certain criteria, including income limitations, residency requirements, and specific circumstances such as disability or age. The program is administered by the Minnesota Department of Revenue, and the application process involves submitting the Minnesota Rent Rebate Form.

Accessing the Minnesota Rent Rebate Form

To begin the process of claiming your rental rebate, you’ll need to obtain the Minnesota Rent Rebate Form. You can find the form on the official website of the Minnesota Department of Revenue or by visiting your local county government office. The form is available in both printable and fillable PDF formats for your convenience.

Once you have the form, carefully read the instructions provided to ensure accurate completion. It’s important to provide all the necessary information and documentation to avoid any delays or complications in processing your application. The Minnesota Rent Rebate Form consists of several sections that require your personal details, rental information, and income documentation.

Filling Out the Minnesota Rent Rebate Form

Now that you have the Minnesota Rent Rebate Form in hand, let’s walk through the process of filling it out correctly to maximize your chances of receiving the rental rebate you deserve.

Section 1: Personal Information In this section, you will be required to provide your full name, address, Social Security number, and contact details. Make sure to enter the information accurately and legibly. Any errors or omissions may delay the processing of your application.

Section 2: Rental Information Here, you’ll need to provide details about your rental property. This includes the name and contact information of your landlord, the address of the rental property, and the monthly rental amount. It’s important to include supporting documentation such as a lease agreement or rental contract to verify the information provided.

Section 3: Household Members List all the individuals who reside with you in the rental property. Include their names, ages, and relationship to you. This section helps determine eligibility based on household size and composition.

Section 4: Income Documentation The income documentation section requires you to provide information about your income sources, such as employment, benefits, pensions, or other sources of income. You’ll need to attach relevant documentation, such as pay stubs, tax returns, or benefit statements, to support your income claims. Ensure that the documentation is up to date and accurately reflects your financial situation.

Section 5: Signature and Certification Before submitting the form, carefully review all the information you’ve provided. Once you are confident that everything is accurate, sign and date the form to certify the authenticity of the information. Remember to keep a copy of the completed form for your records.

Submitting Your Minnesota Rent Rebate Form

After completing the Minnesota Rent Rebate Form, you will need to submit it to the Minnesota Department of Revenue. You have two options for submission: mailing the form or submitting it electronically through the official website.

If you choose to mail the form, make sure to send it to the correct address mentioned in the instructions. It’s advisable to send the form through certified mail or with a tracking number to ensure its delivery and have proof of submission.

For electronic submission, follow the instructions provided on the official website of the Minnesota Department of Revenue. Ensure that you have access to a scanner or a digital copy of the completed form to upload it successfully.

Conclusion

Claiming your rental rebate through the Minnesota Rent Rebate Program can provide valuable financial assistance for renters facing economic challenges. By completing the Minnesota Rent Rebate Form accurately and submitting it on time, you increase your chances of receiving the rebate you deserve.

Remember, the Minnesota Rent Rebate Program is subject to eligibility criteria, and it’s essential to review the program guidelines and requirements before applying. We hope this comprehensive guide has equipped you with the necessary information to navigate the process successfully.

If you have any further questions or need additional assistance, reach out to the Minnesota Department of Revenue or consult with a qualified professional who can guide you through the application process.