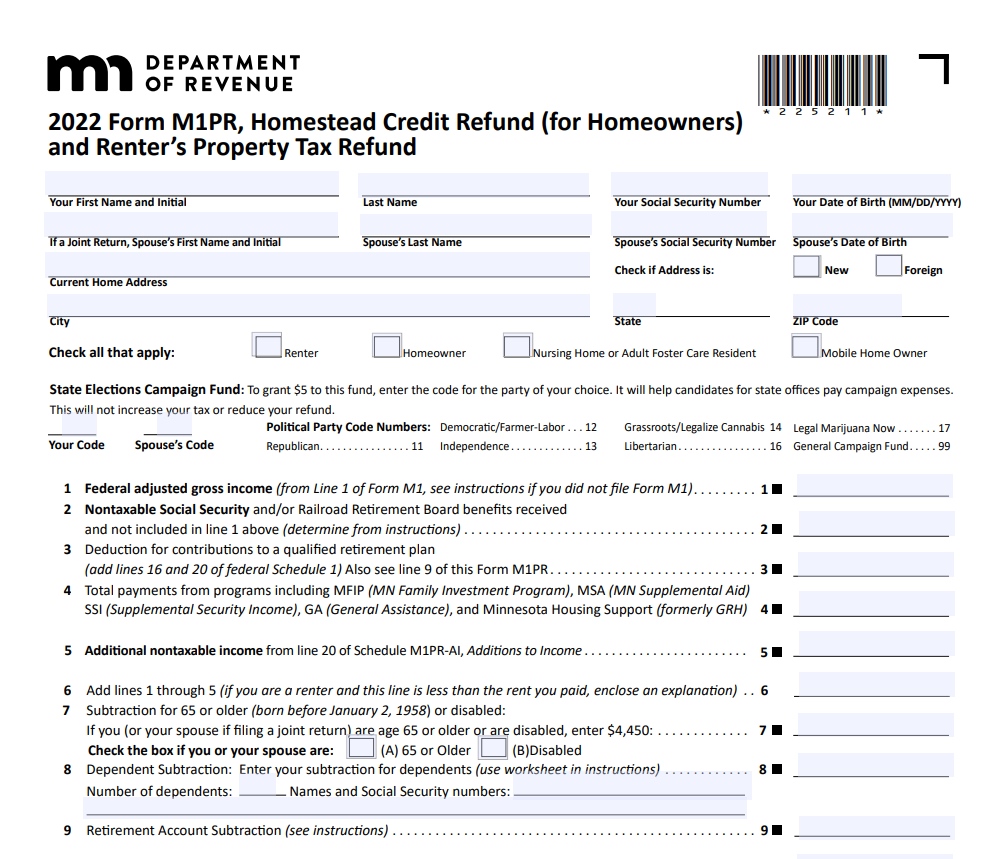

MN Renter Rebate Form – The MN Renter Rebate Form is a state-funded program that provides property tax refunds to eligible renters. This refund helps lower-income renters by offsetting some of their housing expenses. The MN Department of Revenue administers the program and determines eligibility criteria.

Who is Eligible for the MN Renter Rebate?

To be eligible for the MN Renter Rebate, you must meet the following criteria:

- Be a legal resident of Minnesota

- Be 65 years or older, blind, or have a disability

- Have a household income that meets the program’s income requirements

- Have paid rent on your primary residence in Minnesota during the previous year

- Have lived in the property for the full year

How to Apply for the MN Renter Rebate?

To apply for the MN Renter Rebate Form, follow these steps:

- Determine if you meet the eligibility criteria.

- Gather all required documents.

- Choose between online or paper application.

- Fill out the application completely and accurately.

- Submit your application and required documents.

Documents Required to Apply for the MN Renter Rebate

To apply for the MN Renter Rebate Form, you will need the following documents:

- Proof of rent paid during the previous year

- Proof of property tax paid or a rent certificate from your landlord

- Proof of income for all household members

- Social Security numbers for all household members

Important Dates to Remember

The MN Renter Rebate Form application period begins on July 1st and ends on August 15th each year. The MN Department of Revenue processes applications on a first-come, first-served basis, so it’s important to apply as soon as possible. Processing times can take up to six months, and payments are typically issued in September.

FAQs about the MN Renter Rebate Form

Here are some frequently asked questions about the MN Renter Rebate Form:

- What is the maximum refund amount for the MN Renter Rebate? The maximum refund amount is $2,710 for 2022.

- Can I apply for the MN Renter Rebate if I live in subsidized housing? Yes, you can still apply for the MN Renter Rebate even if you live in subsidized housing.

- Can I apply for the MN Renter Rebate if I don’t have a Social Security number? No, a Social Security number is required for all household members to apply for the MN Renter Rebate.

Conclusion

The MN Renter Rebate Form is a helpful program for eligible renters in Minnesota. By providing property tax refunds, the program helps reduce housing expenses for lower-income renters. If you meet the eligibility criteria, it’s important to apply during the application period and submit all required documents to ensure timely processing and payment. For more information, visit the MN Department of Revenue website.