Mn Renter’s Rebate Form 2023 – Welcome to our comprehensive guide on the Mn Renter’s Rebate Form 2023, where we’ll provide you with all the essential information you need to maximize your benefits as a renter in Minnesota. This valuable rebate program is designed to ease the financial burden on eligible renters by providing a tax refund based on their rent and income. Whether you’re a long-time renter or new to the state, this article will guide you through the process of obtaining and completing the Mn Renter’s Rebate Form, ensuring you don’t miss out on the benefits you deserve.

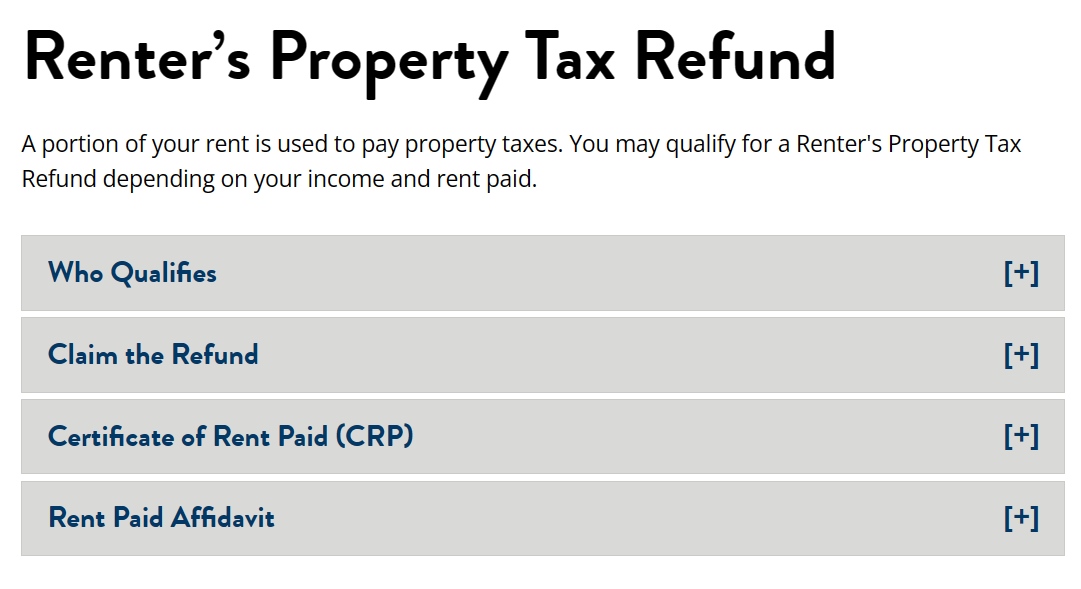

Understanding the Mn Renter’s Rebate Program

The Mn Renter’s Rebate Program is a government initiative aimed at assisting low-income individuals and families with their rental expenses. Administered by the Minnesota Department of Revenue, this program enables eligible renters to receive a refund on a portion of their rent paid throughout the year. The refund amount is determined based on the applicant’s income, rent amount, and household size.

To qualify for the Mn Renter’s Rebate Program, you must meet certain criteria, including being a legal resident of Minnesota, living in a qualifying rental unit, and meeting the income requirements. The program is primarily targeted towards individuals with limited income, ensuring that those who need assistance the most can benefit from the rebate.

Eligibility Requirements for Mn Renter’s Rebate Program

To determine your eligibility for the Mn Renter’s Rebate Program, several factors are taken into account. These include your income, rent amount, and household size. Let’s delve into each of these factors:

Income: The program considers your total household income, including wages, salaries, pensions, Social Security benefits, and other sources of income. There are specific income limits set by the program, and your total household income should fall within those limits to be eligible.

Rent Amount: The rent you pay for your qualifying rental unit is a significant factor in determining your eligibility. The program sets a maximum rent limit, and if your rent exceeds that limit, you may not be eligible for the rebate. However, the program allows for certain adjustments to the rent amount, such as deducting the cost of heat and utilities.

Household Size: The size of your household, including the number of individuals living with you, also plays a role in determining your eligibility. The program considers each member of your household, including dependents, when calculating the rebate amount.

How to Obtain the Mn Renter’s Rebate Form 2023

Obtaining the Mn Renter’s Rebate Form 2023 is a straightforward process. To access the form, you have several options:

- Online: Visit the official website of the Minnesota Department of Revenue. Navigate to the forms section and search for “Mn Renter’s Rebate Form 2023.” Download and save the form to your computer or print it directly.

- In-person: You can obtain a physical copy of the form from the Minnesota Department of Revenue office or any designated tax assistance centers. Visit their office during regular business hours and request the Mn Renter’s Rebate Form 2023.

- By mail: If you prefer to receive the form by mail, you can contact the Minnesota Department of Revenue directly and request them to send you a copy. Provide them with your mailing address, and they will send the form to you promptly.

Completing the Mn Renter’s Rebate Form 2023

Filling out the Mn Renter’s Rebate Form 2023 accurately is crucial to ensure your eligibility and maximize your benefits. Here are some key steps to follow when completing the form:

- Personal Information: Provide your name, address, Social Security number, and other requested personal details. Ensure that the information is accurate and up to date.

- Income Details: Enter your total household income from all sources as required. Attach any necessary documentation or supporting evidence, such as W-2 forms or pay stubs.

- Rent and Utilities: Specify your monthly rent amount, including any adjustments for heat and utilities, if applicable. Double-check the accuracy of these figures.

- Household Information: Include details about each member of your household, such as their names, ages, and relationship to you. This information helps determine the appropriate rebate amount.

- Sign and Date: Once you have completed all the necessary sections of the form, review it thoroughly, sign it, and date it accordingly. Unsigned or incomplete forms may lead to delays in processing.

Submitting the Mn Renter’s Rebate Form 2023

After completing the form, you need to submit it to the Minnesota Department of Revenue to be considered for the Mn Renter’s Rebate Program. Here are the submission options available:

- Online Submission: If you prefer a convenient and fast method, you can submit the form electronically through the official website of the Minnesota Department of Revenue. Follow the instructions provided on the website to ensure a successful submission.

- Mail: Print out the completed form and mail it to the address specified on the form or on the official website of the Minnesota Department of Revenue. Make sure to include any required supporting documents and keep copies of everything for your records.

Conclusion:

The Mn Renter’s Rebate Form 2023 is your gateway to potential financial relief as a renter in Minnesota. By understanding the program, meeting the eligibility criteria, obtaining and completing the form accurately, and submitting it on time, you can unlock the benefits and receive the tax refund you deserve. Take advantage of this opportunity to alleviate your rental expenses and improve your financial well-being. Remember, the Mn Renter’s Rebate Program is here to support you, so don’t hesitate to explore this valuable resource.