PA Rent Rebate 2023 – The PA Rent Rebate Program is a tax relief program offered by the Pennsylvania Department of Revenue to eligible Pennsylvania residents who are either 65 years or older, widows/widowers who are 50 years or older, and people with disabilities who are 18 years or older. The program provides rebates on property taxes or rent paid during the previous year. The deadline for applying for the 2023 program is June 30, 2024.

Eligibility Criteria for PA Rent Rebate

To be eligible for the PA Rent Rebate Program, an applicant must meet the following requirements:

- Be a Pennsylvania resident for at least one full year before the application deadline.

- Be 65 years or older, a widow/widower who is 50 years or older, or a person with disabilities who is 18 years or older.

- Have an annual income of $35,000 or less for homeowners and $15,000 or less for renters.

- Have paid rent or property taxes in the previous year.

- Meet any additional program-specific eligibility requirements.

How to Apply for PA Rent Rebate

To apply for the PA Rent Rebate program, follow these steps:

- Gather the required documents, including proof of income, proof of rent or property taxes paid, and proof of age/disability.

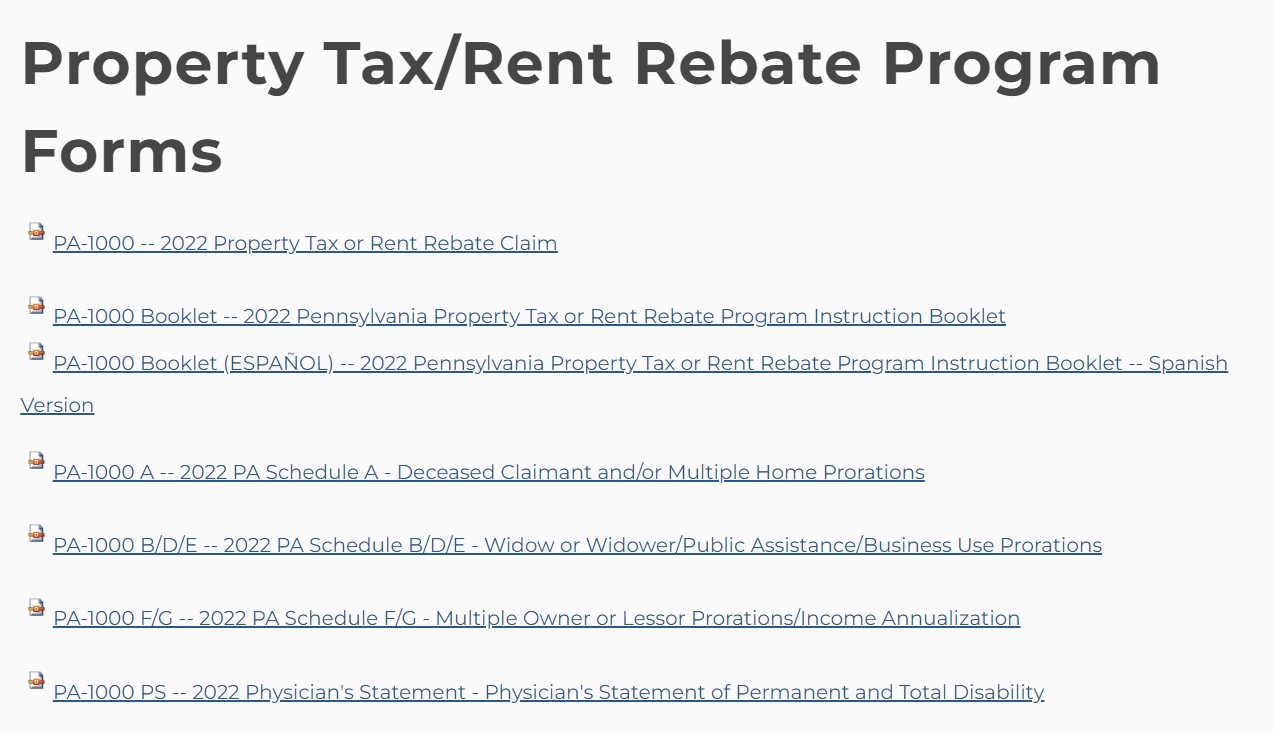

- Download the application form from the Pennsylvania Department of Revenue website or request a form by calling 1-888-222-9190.

- Fill out the form completely and accurately. Make sure to include all necessary information and documentation.

- Submit the completed form and supporting documents by mail to the address provided on the form or by filing online through the Revenue e-Services Center.

- Wait for the Pennsylvania Department of Revenue to process your application. You can check the status of your application online or by calling 1-888-PATAXES.

Tips for Successful Application

To increase your chances of a successful application for the PA Rent Rebate program, consider these tips:

- Apply early to ensure your application is received before the deadline.

- Double-check your application form and supporting documents for accuracy and completeness.

- Keep copies of all documents you submit with your application.

- If you have questions about the application process or eligibility requirements, contact the Pennsylvania Department of Revenue for assistance.

- Be patient as the processing of applications can take several months.

Frequently Asked Questions about PA Rent Rebate

Q: What is the income limit for PA Rent Rebate? A: The income limit for the PA Rent Rebate program is $35,000 or less for homeowners and $15,000 or less for renters.

- Q: Can I apply for PA Rent Rebate if I live in a nursing home?

- A: Yes, if you meet the other eligibility requirements and pay more than 50% of your income on housing costs.

- Q: What is the maximum amount I can receive from PA Rent Rebate?

- A: The maximum rebate amount for the PA Rent Rebate program is $650.

- Q: How long does it take to receive the PA Rent Rebate check?

- A: The processing of applications can take several months. If approved, you can expect to receive your rebate check in the mail by the end of the year.

- Q: What if I miss the deadline for the PA Rent Rebate program?

- A: Unfortunately, late applications are not accepted for the PA Rent Rebate program. Be sure to submit your application before the June 30th deadline to be considered.

In conclusion, the PA Rent Rebate program provides tax relief to eligible Pennsylvania residents who are 65 years or older, widows/widowers who are 50 years or older, and people with disabilities who are 18 years or older. To apply, gather the required documents, fill out the application form, and submit it by mail or online. To increase your chances of a successful application, apply early, double-check your application form and supporting documents, keep copies of all documents, and be patient. If you have any questions about the application process or eligibility requirements, contact the Pennsylvania Department of Revenue for assistance.