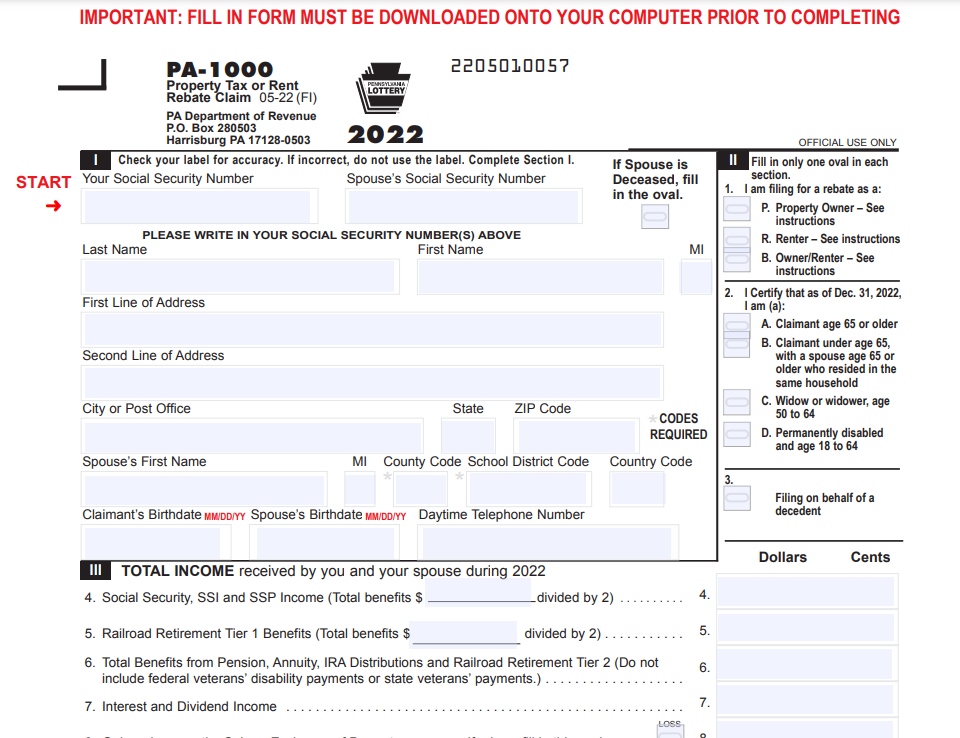

PA Rent Rebate Form – The PA Rent Rebate Form is an application for the Pennsylvania Rent Rebate Program, which provides financial assistance to low-income families, senior citizens, and disabled individuals. The program is designed to help eligible Pennsylvanians pay for their rent or property taxes.

The Pennsylvania Rent Rebate Program has been around for decades, and it has helped countless families and individuals stay in their homes by providing financial relief. The program is funded through the Pennsylvania Lottery, and it is administered by the Pennsylvania Department of Revenue.

By using the PA Rent Rebate Form, eligible individuals can apply for financial assistance to help them pay their rent or property taxes. The program has income limits and other eligibility requirements, which we will discuss in the next section.

Eligibility Requirements for PA Rent Rebate Form

To be eligible for the Pennsylvania Rent Rebate Program, applicants must meet certain requirements. These requirements include:

- Age: Applicants must be 65 years of age or older, or they must be 50 years of age or older and a widow/widower.

- Income: Applicants must meet income limits, which are determined by their county of residence and their marital status.

- Residency: Applicants must have lived in Pennsylvania for at least one year before applying for the program.

For senior citizens and disabled individuals, there are additional eligibility requirements. Senior citizens must be at least 65 years of age and must have a total annual income of $35,000 or less for the year they are applying for the program. Disabled individuals must be at least 18 years of age and must have a total annual income of $15,000 or less for the year they are applying for the program.

The income limits for the Pennsylvania Rent Rebate Program are based on the applicant’s total annual income, including Social Security, Supplemental Security Income (SSI), and other sources of income.

Steps to Fill Out PA Rent Rebate Form

To fill out the PA Rent Rebate Form, applicants will need to follow a few simple steps:

- Download the PA Rent Rebate Form from the Pennsylvania Department of Revenue website or request a form by phone or mail.

- Gather all necessary documents, including proof of income and proof of rent or property tax payment.

- Fill out the form completely, making sure to provide accurate and complete information.

- Sign and date the form.

- Submit the form by mail or online using the Department of Revenue’s website.

When filling out the form, be sure to provide all requested information, including income information, rent or property tax information, and personal information such as name and address.

Tips for Successful PA Rent Rebate Form Filing

To ensure a successful filing of the PA Rent Rebate Form, consider the following tips:

- Double-check all information on the form to ensure accuracy.

- Submit the form as early as possible to avoid missing the deadline.

- Keep copies of all documents and the completed form for your records.

- Contact the Pennsylvania Department of Revenue with any questions or concerns.

- Follow up with the program office to ensure that your application is being processed.

By following these tips, applicants can increase their chances of a successful filing and approval for the Pennsylvania Rent Rebate Program.

Frequently Asked Questions About PA Rent Rebate Form

- Q: What is the deadline for submitting the PA Rent Rebate Form?

- A: The deadline for submitting the PA Rent Rebate Form is June 30th of the year following the year for which you are applying.

- Q: Can I submit the PA Rent Rebate Form online?

- A: Yes, you can submit the form online using the Pennsylvania Department of Revenue’s website.

- Q: What documents do I need to submit with the PA Rent Rebate Form? A

- A: Applicants need to submit proof of income and proof of rent or property tax payment. Other documents may be required depending on the applicant’s individual situation.

- Q: Can I receive both the Pennsylvania Rent Rebate Program and the Low-Income Home Energy Assistance Program (LIHEAP)?

- A: Yes, applicants can receive both programs if they meet the eligibility requirements for each program.

- Q: How long does it take to receive the rebate?

- A: Rebates are typically issued within four to six weeks of application approval.

Conclusion

The Pennsylvania Rent Rebate Program is a valuable resource for eligible individuals who need assistance paying for their rent or property taxes. By using the PA Rent Rebate Form and following the eligibility requirements and filing tips, applicants can increase their chances of success in receiving financial assistance through the program.

If you have any questions or concerns about the Pennsylvania Rent Rebate Program or the PA Rent Rebate Form, be sure to contact the Pennsylvania Department of Revenue for more information.