PA Rent Rebate Form 2023 – The PA Rent Rebate Program is a valuable resource for seniors, widows/widowers, and persons with disabilities who are renting or owning a home. This program provides financial assistance to eligible applicants based on their income, age, and disability status. In this guide, we will provide a step-by-step process to complete the PA Rent Rebate Form for 2023.

Eligibility Criteria

To be eligible for the PA Rent Rebate Program, applicants must meet the following criteria:

- Be a Pennsylvania resident for at least one year before applying

- Be 65 years of age or older; a widow or widower age 50 or older; or a person with disabilities age 18 or older

- Have an annual income of $35,000 or less for homeowners, or $15,000 or less for renters, after allowable deductions

- Have paid rent or property taxes on their primary residence in Pennsylvania during the previous year

- Meet any other requirements established by the PA Department of Revenue

Income Guidelines

The PA Rent Rebate Program has income guidelines that determine the amount of financial assistance an eligible applicant can receive. For 2023, the maximum rebate is $650. To determine your eligibility and the amount of rebate you can receive, use the following income guidelines:

- Homeowners: Maximum income of $35,000 per year

- Renters: Maximum income of $15,000 per year

Note that income includes Social Security, Supplemental Security Income, and other types of income.

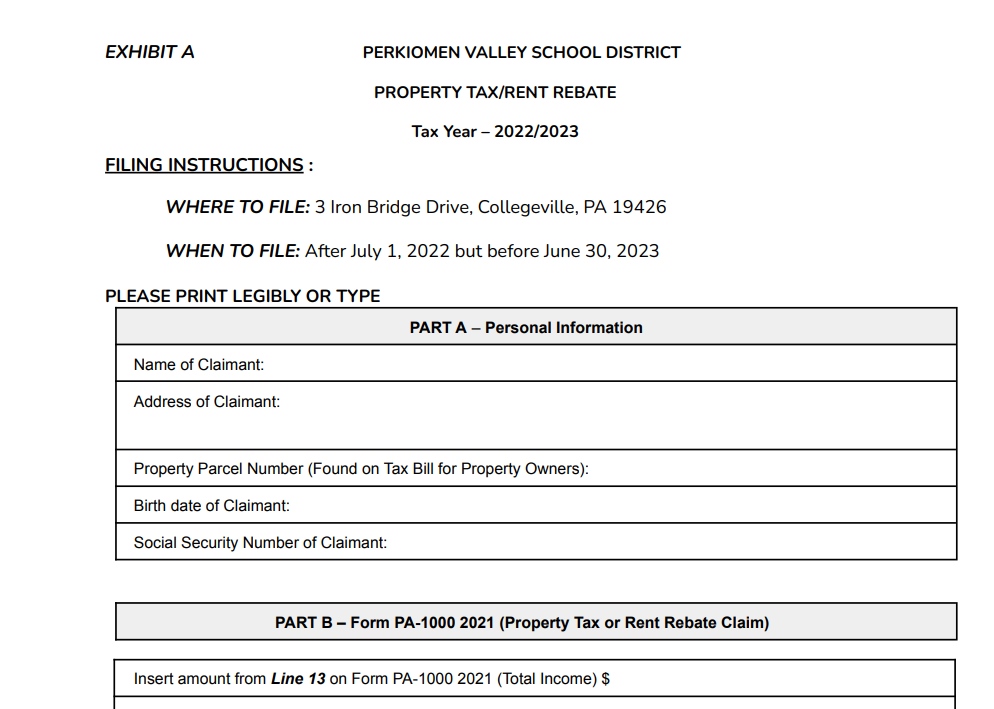

Required Documentation

When completing the PA Rent Rebate Form, you will need to provide the following documentation:

- A copy of your 2022 property tax bill or rent certificate (if renting)

- Proof of all income received in 2022 (such as Form 1099, W-2, or Social Security statement)

- Proof of age, if not already on file with the Department of Revenue

- Proof of disability, if not already on file with the Department of Revenue

Filing Options

You can submit your PA Rent Rebate Form in one of the following ways:

- Online: You can file your form electronically through the PA Department of Revenue’s website.

- By mail: You can print and mail the completed form to the PA Department of Revenue.

- In person: You can visit a Department of Revenue district office to file your form in person.

Online Submission Process

To submit your PA Rent Rebate Form online, follow these steps:

- Visit the PA Department of Revenue’s website.

- Click on “Property Tax/Rent Rebate Program” under “Personal Income Tax.”

- Follow the prompts to enter your information and upload any required documentation.

- Submit your form electronically.

Checking the Status of Your PA Rent Rebate Form

You can check the status of your PA Rent Rebate Form by visiting the Department of Revenue’s website and entering your Social Security number, claim year, and date of birth.

Important Dates and Deadlines

The deadline for submitting the PA Rent Rebate Form for 2023 is June 30, 2024. Applications submitted after this date will not be accepted.

Conclusion

The PA Rent Rebate Program is a valuable resource for eligible seniors, widows/widowers, and persons with disabilities. By following our step-by-step guide, you can complete the PA Rent Rebate Form for 2023 and receive the financial assistance you deserve. Don’t forget to submit your form by the June 30, 2024 deadline to ensure your eligibility.