Pennsylvania Property Tax Rent Rebate – Pennsylvania Property Tax Rent Rebate (PTRR) is a program designed to provide financial relief to eligible seniors, widows and widowers, and people with disabilities. PTRR provides rebates on property taxes and rent paid for the previous year. This program is essential for many Pennsylvanians who struggle to pay property taxes and rent.

Eligibility Criteria

To be eligible for PTRR, you must meet the following criteria:

Age: You must be 65 years or older as of December 31 of the previous year, or you must be 50 years or older and a widow or widower.

Income: Your total annual income must be $35,000 or less for homeowners or $15,000 or less for renters. This includes all income, such as Social Security, pensions, and wages.

Ownership or Renting Status: You must own your home or have a lease agreement with a landlord that requires you to pay property taxes on the property.

Residency Status: You must have lived in Pennsylvania for the entire previous year and be a current resident of the property for which you are seeking rebates.

Disability Status: If you are under 65 years old, you must be totally disabled and have proof of your disability.

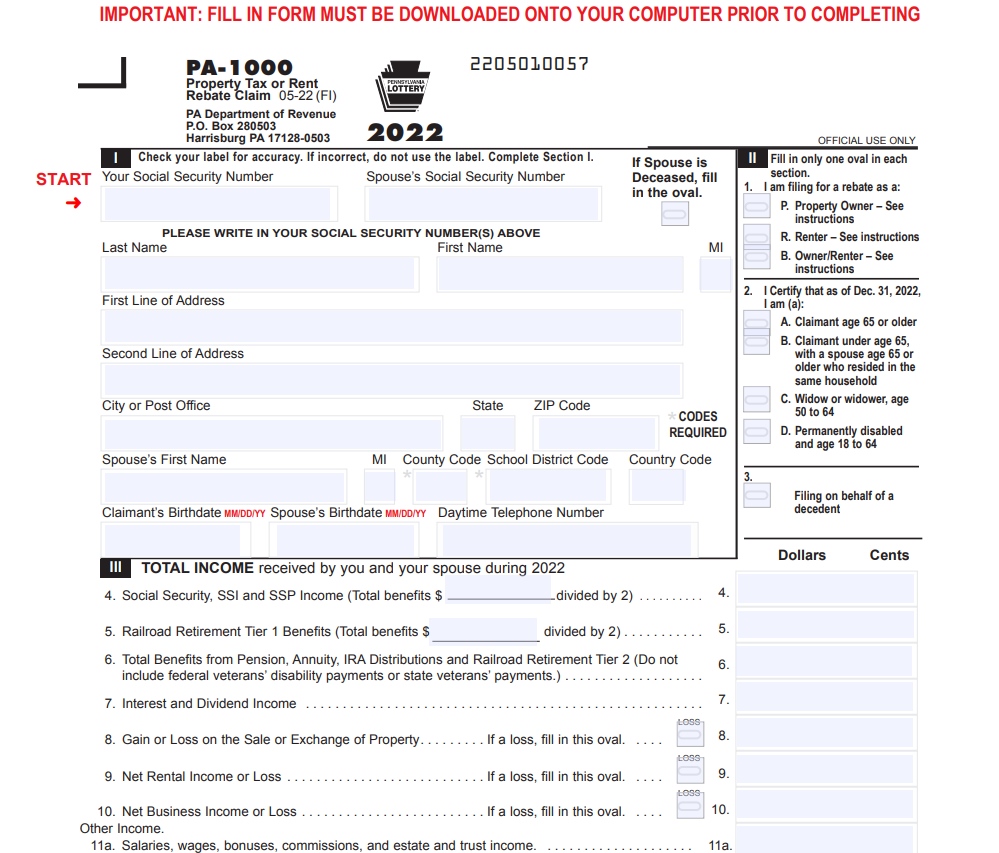

Application Process

To apply for PTRR, you can file an application through one of the following options:

- Online: You can file your application online through the Pennsylvania Department of Revenue’s website.

- In person: You can also file your application in person at one of the Department of Revenue’s district offices, local Area Agencies on Aging, or at certain legislators’ offices.

- By mail: You can download and print an application from the Pennsylvania Department of Revenue’s website and mail it to the department.

Required documentation:

- Proof of age, such as a birth certificate or driver’s license.

- Proof of all income received during the previous year.

- Proof of property taxes paid, such as a receipt or property tax bill.

- Proof of rent paid, such as a rent certificate or lease agreement.

- Documentation of disability, if under 65 years old.

Application tips:

- Read the instructions carefully before filling out the application.

- Double-check all information and make sure it is accurate.

- Keep a copy of your completed application and all supporting documentation.

- Submit your application by the deadline to avoid late fees or penalties.

Deadlines

Application Deadline: The deadline to file a PTRR application for the previous year is June 30th.

Payment Deadline: Rebates are issued starting July 1st of each year. Payments are generally issued within four to six weeks of approval.

Late Application: If you miss the application deadline, you can still file for up to one year after the application deadline. However, you may incur a penalty.

Conclusion

Pennsylvania Property Tax Rent Rebate is an essential program that provides financial relief to eligible seniors, widows and widowers, and people with disabilities. If you meet the eligibility criteria, it is important to apply for PTRR and take advantage of the rebates it provides. By following the application process and submitting your application by the deadline, you can ensure that you receive the financial assistance you need.