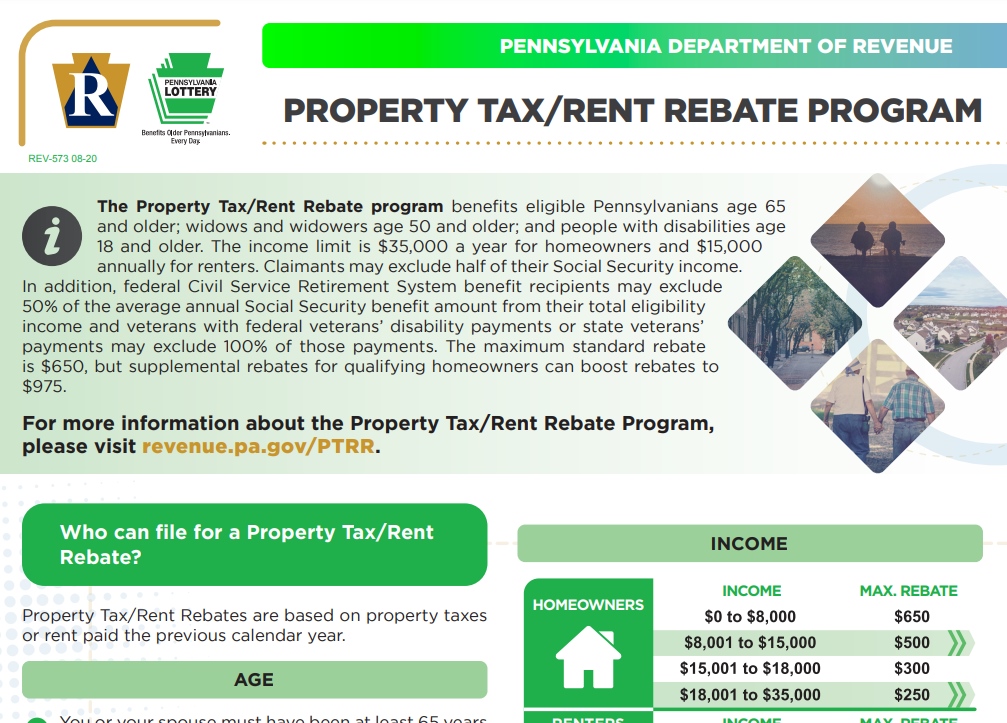

Pennsylvania Rent Rebate – The Pennsylvania Rent Rebate Program is a property tax relief program offered by the Pennsylvania Department of Revenue. It is primarily designed to help low-income renters, especially senior citizens, pay their rent or property taxes. The program provides financial assistance to those who qualify, with the rebate amount based on the applicant’s income, marital status, and number of dependents.

Eligibility Requirements

To be eligible for the Pennsylvania Rent Rebate Program, you must meet the following criteria:

- Be a Pennsylvania resident for at least one year prior to applying

- Be 65 years of age or older, or a widow or widower 50 years of age or older, or a person with a disability 18 years of age or older

- Have a total income of $35,000 or less for homeowners, or $15,000 or less for renters, during the year prior to applying

- Have paid rent or property taxes in Pennsylvania during the year prior to applying

- Meet any other requirements specified by the Pennsylvania Department of Revenue

How to Apply for Rent Rebate in Pennsylvania

To apply for the Pennsylvania Rent Rebate Program, you must complete and submit an application form to the Department of Revenue. Here’s how to do it:

- Obtain a rent rebate application form from the Department of Revenue or download it from their website.

- Fill out the application form completely and accurately.

- Gather all required documents, such as proof of income

Income Limits for Pennsylvania Rent Rebate

The amount of rent rebate you can receive in Pennsylvania depends on your income, marital status, and number of dependents. The maximum rebate amount for the 2022 tax year is $650. Here are the income limits for the Pennsylvania Rent Rebate Program:

- For homeowners: total annual household income of $35,000 or less

- For renters: total annual household income of $15,000 or less

Rent Rebate for Senior Citizens in Pennsylvania

The Pennsylvania Rent Rebate Program is particularly helpful for senior citizens. To be eligible for the program, you must be at least 65 years old. Senior citizens may qualify for a higher rebate amount if they meet the other eligibility requirements.

Pennsylvania Property Tax Relief for Low-Income Families

The Pennsylvania Rent Rebate Program is one of several programs that provide property tax relief for low-income families in Pennsylvania. In addition to the Rent Rebate Program, there are also programs like the Homestead Exemption Program, which provides tax relief to homeowners, and the Property Tax/Rent Rebate Program, which provides rebates for property taxes paid by homeowners.

Tips for Successful Pennsylvania Rent Rebate Application

To increase your chances of a successful Pennsylvania Rent Rebate application, follow these tips:

- Carefully read the instructions on the application form and provide all required information.

- Ensure that your income and expenses are accurately reported on the application form.

- Provide all necessary documentation to support your application.

- Keep a copy of your completed application form and all supporting documents for your records.

- Contact the Department of Revenue if you have any questions or need assistance with your application.

Conclusion

The Pennsylvania Rent Rebate Program provides financial assistance to low-income renters, particularly senior citizens, to help them pay their rent or property taxes. Eligibility is based on income, age, and residency. To apply, complete and submit an application form to the Department of Revenue, along with all required documents. By taking advantage of this program, eligible individuals can receive valuable property tax relief and reduce their financial burden.