Property Tax Rent Rebate Program – As a tenant, managing your monthly expenses can be challenging, especially when property taxes continue to rise. However, there is a ray of hope for renters in the form of the Property Tax Rent Rebate Program. This unique initiative aims to provide financial relief by offering rebates on property taxes to eligible tenants. In this article, we will delve into the details of this program, highlighting its benefits, eligibility criteria, and the simple steps to apply. Discover how you can take advantage of this program and alleviate the burden of property taxes.

Understanding the Property Tax Rent Rebate Program

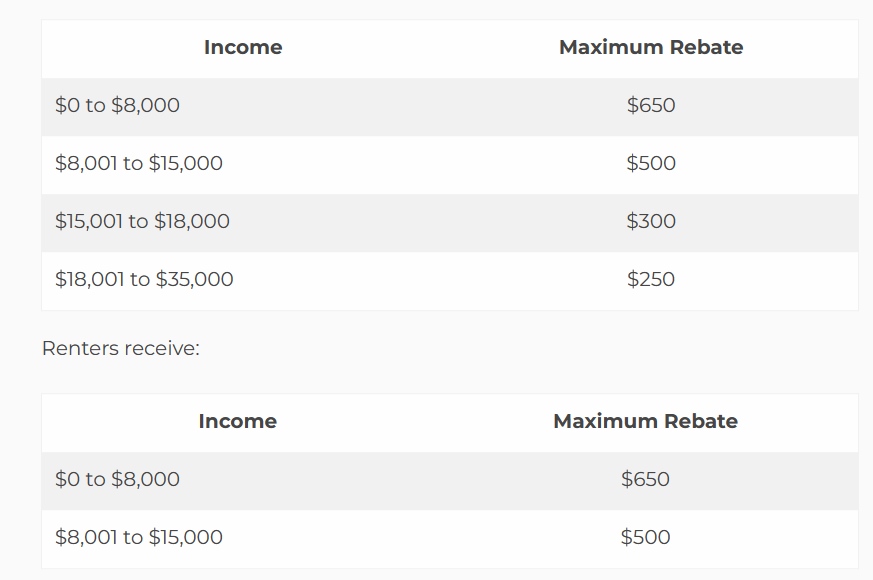

The Property Tax Rent Rebate Program is a government-funded initiative designed to assist eligible tenants in reducing the impact of property taxes on their monthly expenses. The program aims to provide relief by offering rebates based on the portion of property taxes paid by the tenant. By participating in this program, tenants can benefit from substantial savings and allocate those funds toward other essential needs.

To qualify for the Property Tax Rent Rebate Program, tenants must meet certain criteria established by the government. These criteria typically include income limitations, residency requirements, and compliance with local tax regulations. Eligibility varies by jurisdiction, so it is essential to check with your local authorities to determine if you qualify.

The Benefits of Participating

Participating in the Property Tax Rent Rebate Program can yield several significant benefits for tenants. Firstly, the program allows eligible individuals to reduce their monthly expenses by receiving a rebate on a portion of the property taxes they pay as renters. This can result in substantial savings, easing the financial burden and providing tenants with greater financial stability.

Additionally, the Property Tax Rent Rebate Program contributes to fostering a sense of community and social support. By providing financial relief to tenants, the program helps ensure that individuals and families can afford suitable housing options, promoting a healthier and more inclusive society. Moreover, by participating in this program, tenants contribute to the overall economic well-being of their communities.

How to Apply for the Property Tax Rent Rebate Program

Applying for the Property Tax Rent Rebate Program is a relatively straightforward process. To get started, gather all the necessary documents, including proof of income, rental agreements, and any other supporting paperwork required by your local tax authority.

Next, complete the application form provided by the tax authority or the relevant government department. Ensure that you provide accurate and up-to-date information to avoid any delays in processing your application. Double-check that you have included all the required documents and submit your application within the designated timeframe.

Tips for Maximizing Your Rebate

While the Property Tax Rent Rebate Program offers valuable savings, there are a few additional tips to help you maximize the benefits:

- Stay informed: Keep yourself updated on any changes or updates to the program guidelines. This will ensure that you remain eligible and don’t miss out on any potential rebates.

- Maintain organized records: Keep all relevant documents, such as rental agreements, income statements, and property tax receipts, in a secure and easily accessible location. This will make it easier for you to complete the application accurately and provide necessary supporting documentation.

Conclusion

The Property Tax Rent Rebate Program is a remarkable initiative that provides tenants with a means to reduce their financial burden and enhance their quality of life. By participating in this program, eligible renters can benefit from valuable savings and contribute to building stronger, more supportive communities.