Rent Rebates Pennsylvania – The Property Tax/Rent Rebate Program is a program offered by the Pennsylvania Department of Revenue. The program is designed to provide financial assistance to eligible senior citizens, disabled individuals, and low-income families who rent or own their homes. The program provides rebates on property taxes or rent paid during the year.

Eligibility Requirements:

- Applicants must be Pennsylvania residents

- Must have paid rent or property taxes on their primary residence in Pennsylvania during the year for which they are applying

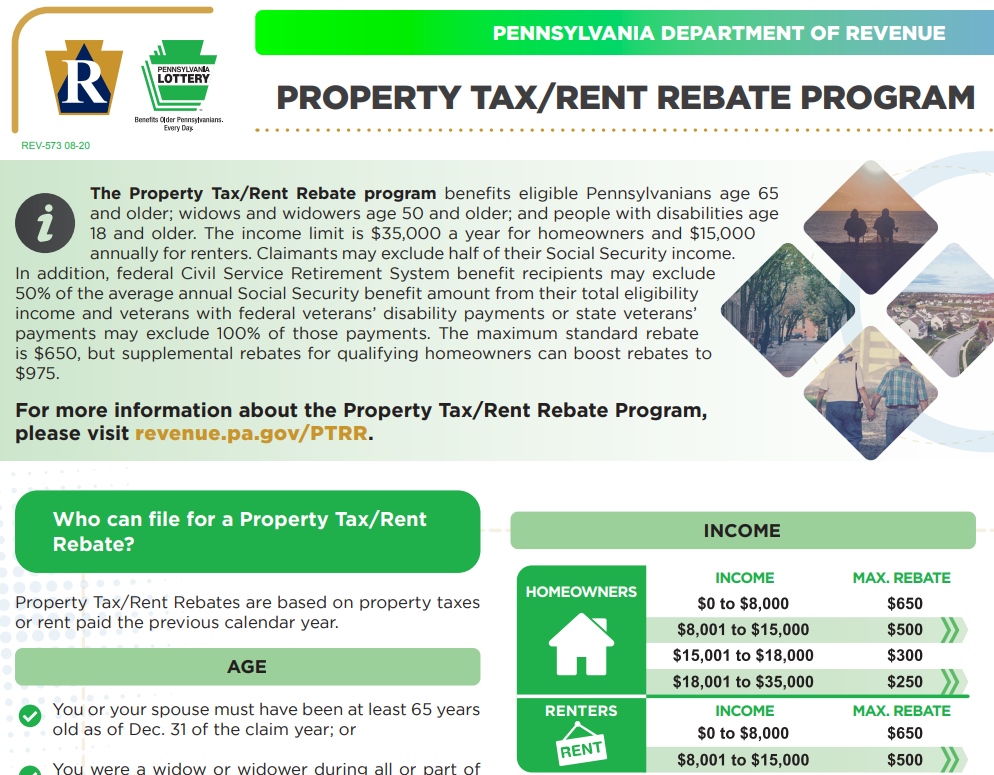

- Must have a total annual income of $35,000 or less for homeowners or $15,000 or less for renters

- Seniors who are 65 years or older, widows/widowers who are 50 years or older, and individuals with disabilities who are 18 years or older are eligible to participate

How to Apply for Rent Rebates in Pennsylvania

To apply for rent rebates in Pennsylvania, follow these steps:

- Obtain the Rent Rebate Application form: The application form can be obtained by visiting the Pennsylvania Department of Revenue website or by contacting the Department of Revenue directly.

- Fill out the application: Provide all required information and documentation, including proof of income and rent paid or property taxes paid during the year for which you are applying.

- Submit the application: Submit the completed application form to the Pennsylvania Department of Revenue by mail, fax, or online through the Department’s website.

- Wait for a response: Once your application has been processed, you will receive a notice of the rebate amount you are eligible to receive.

Required Documents:

- Proof of age, disability, or widowhood (if applicable)

- Proof of rent paid or property taxes paid during the year for which you are applying

- Proof of income, including Social Security income, pensions, wages, interest, and dividends

Application Deadline:

The deadline to apply for rent rebates in Pennsylvania is June 30th of each year.

Frequently Asked Questions about Rent Rebates in Pennsylvania

- Income requirements for rent rebates: To be eligible for rent rebates in Pennsylvania, homeowners must have a total annual income of $35,000 or less, and renters must have a total annual income of $15,000 or less.

- Maximum rebate amount: The maximum rebate amount for rent rebates in Pennsylvania is $650 for homeowners and $975 for renters.

Who is eligible for rent rebates in Pennsylvania?

Senior citizens who are 65 years or older, widows/widowers who are 50 years or older, and individuals with disabilities who are 18 years or older are eligible for rent rebates in Pennsylvania if they meet the income and other eligibility requirements.

In conclusion, the Property Tax/Rent Rebate Program in Pennsylvania is designed to provide financial assistance to eligible residents who rent or own their homes. To apply for rent rebates, applicants must meet certain eligibility requirements and provide documentation of income and rent paid or property taxes paid during the year. The deadline to apply is June 30th of each year, and the maximum rebate amount varies depending on whether the applicant is a homeowner or renter.